Business

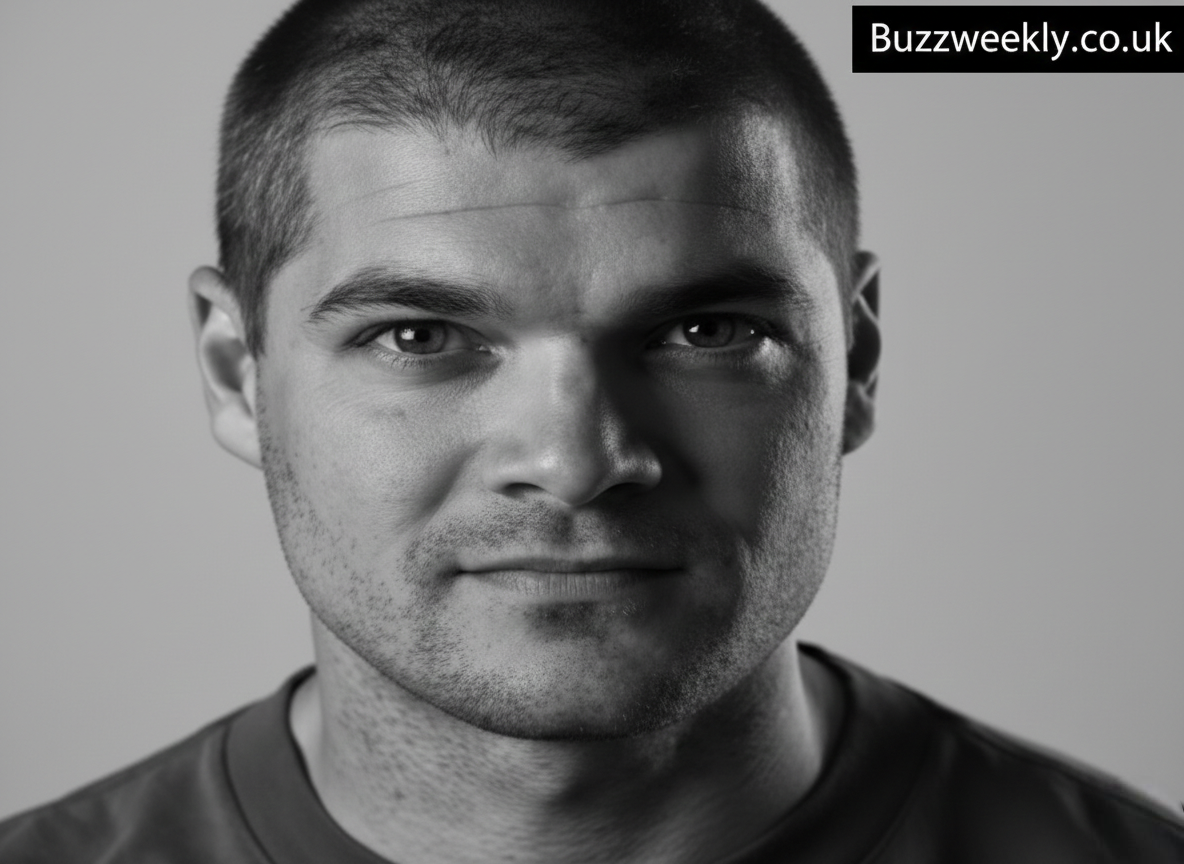

David Martinez Businessman: Stealth Debt King

Who Is David Martinez?

David Martínez Guzmán is a Mexican-born billionaire investor best known for making huge returns by buying distressed corporate and sovereign debt through his firm Fintech Advisory. Often described as a “mysterious” or “ghost” investor, he operates with extreme discretion despite holding multibillion‑dollar positions in Latin American telecoms, media, banking, and government bonds. His deals have reshaped debt markets from Mexico to Argentina and Spain, making him one of the most influential figures in global emerging‑market finance.

Early Life And Education

David Martinez was born in 1957 in Monterrey, Nuevo León, a northern Mexican industrial hub dominated by large family‑run conglomerates. Monterrey’s Group of 10 business elite, including the powerful Sada family, shaped the region’s finance and industry culture, and Martinez later built deep connections with this circle despite not belonging to it by birth.

Before becoming a financier, Martinez seriously considered a religious vocation and joined Regnum Christi, a Catholic movement linked to the Legionaries of Christ. He went on to study technological engineering in Monterrey, philosophy in Rome, and later completed graduate studies at Harvard, where he also taught, giving him an unusual mix of technical, philosophical, and financial training.

Will You Check This Article: Arjun Nagpal: Finance Leader And Visionary

First Steps In Finance

After Harvard, Martinez joined Citigroup in New York, entering global finance just as Latin America’s debt crises of the 1980s were unfolding. Observing how panic pushed the prices of bonds far below their true economic value, he began to specialize in distressed debt, where investors buy troubled obligations at deep discounts and profit if they can be restructured or repaid. This early experience convinced him that sovereign and corporate crises, while risky, offered outsized opportunities for disciplined contrarian investors who understood politics and macroeconomics.

Founding Fintech Advisory

In 1987, around his 30th birthday, Martinez launched Fintech Advisory, reportedly helped by a 300,000‑dollar loan from his grandmother that he repaid with interest within a year. Fintech Advisory was set up as a specialized investment firm focused on distressed and special‑situations debt in emerging markets, operating from bases in New York and later London. Over time, Fintech evolved from a niche hedge fund into a powerful, low‑profile vehicle that quietly built large positions in Latin American companies, banks, and government bonds.

Strategy: Distressed Debt And Restructuring

Martinez’s core strategy is to buy distressed bonds and loans of companies or countries facing serious financial trouble, then work aggressively on restructuring terms to unlock long‑term value. Unlike short‑term traders, he often holds positions for years, seeking influence in negotiations and, in some cases, control of the underlying company through debt‑for‑equity swaps. This approach requires deep legal, political, and economic insight but can generate huge returns when a business or country eventually recovers.

Landmark Deal: CYDSA Turnaround

One of his most famous deals involved Celulosa y Derivados (CYDSA), a Mexican chemicals and textile conglomerate that had once rejected him for a job. When CYDSA became distressed, Fintech bought about 400 million dollars of its debt for roughly 40 million dollars, then converted this into equity, gaining around 60 percent of the company and taking control from its founding family. The transaction became a textbook example of how distressed investors can use debt markets to acquire major industrial assets at a fraction of their original value.

Battles Over Vitro And Mexican Industry

Martinez also played a central role in the saga of Vitro, one of the world’s largest glass manufacturers, which defaulted on over 1.5 billion dollars of debt. Fintech provided a 75‑million‑dollar loan secured by properties and later bought hundreds of millions of dollars of Vitro’s distressed claims from banks, becoming its largest outside creditor. Through complex restructuring and legal battles, he positioned himself to benefit from Vitro’s recovery, drawing both criticism and admiration for his aggressive but sophisticated tactics.

Sovereign Debt: Argentina And Beyond

Martinez became particularly influential in Argentina’s sovereign debt restructuring after the country’s early‑2000s default. Between 2004 and 2006, he reportedly paid around 100 million dollars for Argentine bonds with a nominal value of about 700 million dollars, making Fintech one of the major participants in the 2005 debt exchange. He publicly argued that large reductions in Argentina’s liabilities were essential for growth and creditworthiness, and his positions made him a key player in negotiations that shaped the country’s post‑crisis financial path.

Building A Media And Telecom Empire

Beyond bonds, Martinez expanded into media and telecommunications, particularly in Argentina. In 2007 Fintech became a 40 percent owner of Cablevisión, the cable TV unit of Grupo Clarín, Argentina’s largest media group, and later helped drive the merger that created Telecom Argentina as a major regional telecom operator. By 2024 he also held a significant stake of about 7.8 percent in Grupo Televisa, Latin America’s largest media conglomerate, cementing his influence across Spanish‑language media and telecom infrastructure.

European Banking Bets: Banco Sabadell

Martinez’s reach extends to European banking, most notably Banco Sabadell in Spain. In 2013 he invested about 325 million euros via Fintech Advisory in a capital increase, becoming a major shareholder in the recovering bank and later holding roughly 3.86 percent of its shares. He joined Sabadell’s board and remained a crucial voice during takeover debates, eventually stepping down in 2025 after a high‑profile failed bid by BBVA while still being recognized as a key investor in the Spanish financial sector.

Net Worth And Lifestyle

Martinez keeps his personal finances highly opaque, but regulatory disclosures and rich‑list estimates have offered rare glimpses. The Bloomberg Billionaires Index valued his net worth at about 2.4 billion dollars in 2016, while some later estimates and media profiles have described him as a multibillionaire with a fortune possibly in the 4‑billion‑dollar range. He owns one of Manhattan’s most expensive apartments, a roughly 12,000‑square‑foot duplex atop the Time Warner Center that he bought for around 42 million dollars in 2003 and lavishly renovated, yet he maintains a low‑key public profile and spends heavily on a private art collection rather than public status symbols.

Reputation: “Ghost Investor” And Controversies

In financial circles, Martinez is often called a “ghost investor” or “black box” because Fintech has no public‑facing website and he rarely gives interviews. Supporters see him as a brilliant, disciplined contrarian who provides crucial capital to distressed economies and companies when few others are willing to take the risk. Critics argue that his aggressive use of legal structures, particularly in cases like Vitro, sometimes puts him at odds with other creditors and raises questions about fairness and transparency in complex restructurings.

Philanthropy, Faith, And Art

Although Martinez generally avoids publicity, his strong Catholic faith and philosophical background have influenced how colleagues describe his personal life. Reports highlight his deep interest in art, noting that he has assembled a significant private collection and treats collecting as a serious passion rather than a branding exercise. Public information about specific philanthropic projects is limited, consistent with his overall preference for discretion over high‑profile charity campaigns.

People also like this: eTarget Limited: A Complete Guide to Smart, Targeted Digital Advertising

Legacy And Influence In Global Finance

Martinez’s legacy lies in showing how a highly focused, low‑profile investor from Mexico could quietly become one of the most powerful players in global distressed debt. His work on sovereign restructurings, corporate turnarounds, and telecom and media consolidation demonstrates how finance, law, and politics intersect in emerging markets, often behind closed doors. For many observers, his career illustrates both the vital role and the controversial power of hedge‑fund‑style investors in resolving major financial crises.

Conclusion

David Martinez’s journey from Monterrey engineering student and would‑be priest to billionaire “ghost investor” on Wall Street captures the untold side of modern global finance. Through Fintech Advisory, he has built vast influence over distressed debt, media, telecoms, and banking in Latin America and Europe while remaining intensely private, leaving his deals—not his public persona—to define his impact on markets and economies.

FAQs

Who is David Martinez in business?

David Martínez Guzmán is a Mexican billionaire investor and founder of Fintech Advisory, a firm specializing in distressed sovereign and corporate debt, especially in emerging markets. He is widely regarded as one of the most influential and secretive figures in global bond and restructuring markets.

What is David Martinez’s estimated net worth?

Regulatory disclosures and the Bloomberg Billionaires Index have estimated Martinez’s wealth at around 2.4 billion dollars in the mid‑2010s, with some sources later suggesting a fortune near 4 billion dollars. Exact figures are uncertain because his holdings are mostly private and he does not publicly discuss his finances.

What is Fintech Advisory and what does it do?

Fintech Advisory is Martinez’s investment firm, founded in 1987, that focuses on buying and restructuring distressed debt from troubled companies and governments, particularly in Latin America and Europe. The firm often acquires large positions, participates directly in negotiations, and sometimes converts debt into equity to gain control of strategic assets.

Why is David Martinez considered mysterious?

Martinez rarely gives interviews, keeps Fintech off the public web, and discloses only what regulations require, leading analysts to describe him as a “black box” or “ghost investor.” Despite this, filings reveal multibillion‑dollar stakes across telecoms, media, and banking, making his influence far greater than his public visibility.

What are some of his most notable investments?

Among his best‑known deals are the CYDSA debt‑for‑equity takeover in Mexico, the contentious Vitro restructuring, large purchases of Argentine sovereign bonds, and a 40 percent stake in Cablevisión that helped shape Telecom Argentina. He has also invested heavily in Banco Sabadell in Spain and holds a significant stake in Grupo Televisa, the largest media company in Latin America.

Business

Christopher Wooden: The Innovator Behind Modern Mobile Banking Experiences

Introduction

Christopher Wooden is a name that’s steadily becoming synonymous with innovation in mobile technology and digital financial services. As a highly skilled iOS developer, Christopher Wooden has played a crucial role in shaping how millions of people interact with their money through mobile apps. In today’s digital age, understanding the people behind the tech we use every day matters — and that’s exactly why the story of Christopher Wooden is worth exploring. This article will take you on an in-depth journey through his background, career milestones, technical contributions, and the broader influence he continues to have in fintech and app development.

Quick Bio

| Category | Detail |

|---|---|

| Full Name | Christopher Wooden |

| Birthplace | Guildford, England |

| Nationality | British |

| Education | University of Teesside (Computer Science & Software Engineering) |

| Profession | Senior iOS Developer |

| Industry | Fintech / Mobile App Development |

| Notable Work | Lead iOS development at Monzo Bank |

| Years Active | 15+ years |

| Expertise Areas | Swift, Objective-C, UX Design, Mobile Security |

Who Is Christopher Wooden?

Christopher Wooden is a seasoned iOS developer from Guildford, England with a strong track record in crafting high-performance mobile applications, particularly in the financial technology (fintech) sector. His expertise lies in building intuitive, secure, and scalable iOS apps that tens of millions of users rely on daily. One of his most prominent roles has been with Monzo Bank, a leading digital bank known for its user-centric mobile app design and cutting-edge functionality.

Will You Check This Article: Kilkee Benches Replaced Plastic for a Greener Coast

Wooden’s journey illustrates the intersection of deep technical skill and forward-thinking design — a blend that has helped push the boundaries of mobile banking experiences.

Early Life and Education

Christopher Wooden’s interest in technology began at a young age. Growing up in Guildford, he developed a fascination with computers and software at a time when mobile technology was rapidly evolving. This passion eventually led him to study Computer Science and Software Engineering at the University of Teesside, where he gained a foundational understanding of coding, user experience (UX), and systems architecture — skills that would later serve as the bedrock of his professional career.

His academic background equipped him with both theoretical knowledge and real-world problem-solving abilities, allowing him to thrive in competitive tech environments.

Career Beginnings

After graduating from university, Christopher Wooden entered the tech industry with enthusiasm and a clear focus on mobile development. He explored various roles that deepened his expertise in app design, development, and optimization. Over time, his ability to write clean, efficient code in languages like Swift and Objective-C set him apart as a developer who could build complex, user-friendly applications without compromising performance or security.

Wooden’s early work laid the groundwork for what would become a career defined by innovation, adaptability, and leadership within the iOS development community.

Rise to Prominence at Monzo Bank

Christopher Wooden’s most impactful professional milestone came when he joined Monzo Bank — one of the UK’s most successful digital banks. Monzo has distinguished itself through a mobile-first approach to banking, and the design and functionality of its iOS app have been central to its success.

At Monzo, Wooden has been deeply involved in developing and refining features that millions of users interact with daily. His responsibilities have spanned:

- Enhancing app performance and responsiveness

- Improving user-experience (UX) design

- Implementing secure financial data practices

- Leading collaborative efforts between developers and cross-functional teams

These contributions have helped Monzo maintain its position as a leader in digital banking and empowered users to manage their finances more intuitively.

Technical Expertise and Skills

Christopher Wooden’s technical skill set is robust and aligned with modern software development best practices. Some of his core competencies include:

- Swift & Objective-C: The primary languages for iOS development.

- SwiftUI & UIKit: Frameworks for building app interfaces.

- Combine & Reactive Programming: For effective data handling and event responses.

- Performance Optimization: Ensuring apps run smoothly on millions of devices.

- Secure Coding Practices: Protecting sensitive financial data.

- Clean Architecture Principles: Such as MVC and MVVM for maintainable, scalable code structures.

His mastery in these areas has enabled him to craft applications that are not only functional but also highly engaging for end users.

Impact on Fintech and Mobile User Experience

Wooden’s influence extends beyond writing code. In the fintech space, he has helped shape how users perceive and use mobile banking apps. The app features he has worked on address real-world user needs, such as:

- Real-time notifications and transaction alerts

- Easy-to-understand budgeting tools

- Effortless navigation and accessibility for all users

These advances have not only improved customer satisfaction but have also contributed to broader trends in mobile finance — pushing banks to adopt more user-centric, app-driven strategies.

Leadership and Mentorship

In addition to his technical contributions, Christopher Wooden has been an informal mentor to emerging developers. Within team environments, his emphasis on best practices, collaboration, and thoughtful problem solving has helped create a culture of excellence. His colleagues describe him as someone who is not just focused on building great software but also on helping others grow their own skills and confidence.

This leadership — grounded in deep technical understanding and human-centered collaboration — is a hallmark of Wooden’s long-term impact on the field.

Challenges and Growth

Like any long-term innovator, Christopher Wooden’s journey has involved overcoming obstacles. Mobile technology evolves rapidly, and developers are constantly required to learn new frameworks, languages, and design paradigms. Wooden’s ability to stay ahead of these changes — while continuing to deliver value — speaks to his resilience and passion for lifelong learning.

His career provides a reminder that growth in tech isn’t just about mastering tools, but about adapting intelligently to new challenges.

People also like this: Cñims: Revolutionizing AI Management Systems

The Future of Christopher Wooden’s Career

Looking forward, Christopher Wooden is poised for continued influence in the world of tech and fintech. With the rise of AI-driven user experiences, biometric security, and next-level performance optimization, his skill set positions him well for future leadership roles such as:

- Head of Mobile Engineering

- Chief Technology Officer (CTO)

- Fintech Consultant

- Innovator in mobile security systems

As digital banking and mobile apps evolve, Wooden’s blend of deep technical knowledge and user-centric design makes him a key figure to watch.

Conclusion

Christopher Wooden’s career is a powerful example of how dedication, technical skill, and thoughtful design can transform everyday experiences — like managing your money — into intuitive and secure digital journeys. From his early days studying software engineering to leading important development work at Monzo Bank, Wooden has shown what it means to be a forward-thinking innovator in tech. His impact reaches beyond individual projects; it reflects broader trends in how we engage with digital financial tools.

For those interested in mobile development or fintech, Christopher Wood story is both instructive and inspiring — a meaningful reminder that technology, when crafted with care, can truly improve lives.

Frequently Asked Questions (FAQs)

1. What does Christopher Wooden do?

Christopher Wooden is a senior iOS developer, known for his work building user-friendly and secure mobile banking applications.

2. Where did Christopher Wooden study?

He studied Computer Science and Software Engineering at the University of Teesside.

3. Which company is Christopher Wooden associated with?

He is notably associated with Monzo Bank, where he has helped develop iOS app features.

4. What are Christopher Wooden’s technical specialties?

His expertise includes Swift, Objective-C, SwiftUI, performance optimization, and secure coding practices.

5. What impact has Christopher Wooden had on fintech?

Wooden’s work has contributed to intuitive mobile banking experiences, impacting how users interact with digital finance tools.

Business

Cory Hein: Mining Engineer Revolutionizing Teck Resources

Cory Hein stands out as a dedicated mechanical engineer shaping Canada’s mining future at Teck Resources Limited. Based in Fernie, British Columbia, he’s spent nearly two decades driving innovation, safety, and efficiency in one of the world’s toughest industries. You’ll discover his journey from university grad to leadership expert, his tech pushes, and why pros like him matter now more than ever. This piece dives deep into what makes Cory Hein a quiet force in mining.

Introduction

Imagine grinding through massive machinery in remote mountains, where one breakdown could halt production worth millions and risk lives—that’s the world Cory Hein navigates daily. As a mechanical engineer at Teck Resources Limited, he’s not just fixing gears; he’s transforming how mining operations run smarter and safer. Cory Hein embodies the blend of grit, brains, and heart that keeps Canada’s resource sector humming amid global pressures like climate rules and tech shifts. In this article, you’ll uncover his education, career climbs, leadership secrets, and game-changing innovations. By the end, you’ll see why engineers like Cory Hein are the unsung heroes powering sustainable industry growth. His story shows anyone can lead change from the shop floor up.

Will You Check This Article: Trey Kulley Majors: Life, Family, Career, and Legacy

Early Life and Education

Cory Hein kicked off his path at the University of British Columbia, diving into mechanical engineering from 2004 to 2008. Picture a young guy in Vancouver labs, wrestling with thermodynamics and design projects while the world economy teetered on the 2008 crash edge. He graduated with a Bachelor of Science, armed with the nuts-and-bolts knowledge to tackle real-world machines. But Cory Hein didn’t stop there; between full-time jobs, he chased a Master of Arts in Organizational Leadership at Royal Roads University starting in 2015. Juggling night classes on change management and team dynamics with day shifts in dusty mines? That’s commitment. This combo gave him rare skills—technical wizardry plus people-leading savvy. It’s like upgrading from a sports car engine to a self-driving smart vehicle. His education set him apart in an industry hungry for leaders who fix equipment and inspire crews. Today, that foundation fuels his impact at Teck, proving early investments pay off big in high-stakes fields.

| Milestone | Year | Details |

|---|---|---|

| BSc Mechanical Engineering | 2008 | University of British Columbia; focused on project design and systems. |

| MA Organizational Leadership | ~2018 | Royal Roads University; emphasized strategy and team building. |

| Joined Teck Resources | 2008 | Started as project engineer amid financial crisis. |

| Reliability Engineering Shift | 2010 | Moved to predictive maintenance roles. |

Career Beginnings at Teck

Right out of school in May 2008, Cory Hein landed at Teck Resources Limited as a project engineer—perfect timing? Hardly, with the global financial meltdown looming. Yet he dove in, coordinating teams on massive builds and ensuring timelines held amid chaos. Think coordinating crane lifts and pipe installs in roaring coal sites, learning that delays cost fortunes. By January 2010, he’d shifted to reliability engineering, where the real grind began. Here, Cory Hein pored over data logs, spotting wear patterns before trucks or crushers failed. It’s detective work on steroids: one overlooked vibration could mean days offline. His hands-on fixes boosted uptime, earning nods from bosses. Peers recall him as the guy who simplified complex repairs without ego. This phase built his rep as a doer, not a desk jockey. Those early years honed instincts that later scaled to bigger roles, showing how starting small forges unbreakable pros. Cory Hein’s persistence turned crisis entry into a launchpad.

Rise to Leadership Roles

Cory Hein climbed steadily, hitting Shop Maintenance Foreman and senior engineering spots by 2016. No flashy promotions; just results speaking volumes. As foreman, he oversaw crews fixing multimillion-dollar haulers under tight deadlines, blending tech know-how with crew motivation. His Royal Roads master’s shone here—applying conflict resolution to defuse shop-floor tensions or rallying teams for overtime pushes. Imagine leading 20 roughneck mechanics through a blizzard shutdown; that’s his turf. He aligned field fixes with corporate goals, cutting waste while boosting morale. Colleagues praise his no-BS style: call out issues early, empower fixes, celebrate wins. This shift marked Cory Hein as more than an engineer—a builder of high-performing units. In rigid mining hierarchies, his collaborative vibe stood out, fostering trust that sped decisions. His trajectory proves leadership blooms from proving yourself in the trenches first.

Key Leadership Transitions

From project engineer to reliability whiz, then foreman—each step layered skills. By mid-2010s, Cory Hein tackled long-term modernization, planning upgrades without halting output. He bridged departments, ensuring engineers chatted with operators for real insights. This era tested his organizational leadership chops, mediating between old-school vets and tech-curious newbies. Results? Smoother handoffs, fewer errors. One anecdote floats around: he revamped a failing conveyor system mid-peak season, saving weeks of downtime through team brainstorming. Such moves solidified his role as a strategic player. Cory Hein’s rise underscores how blending degrees with dirt-under-nails experience crafts elite leaders.

Innovations in Mining Tech

Cory Hein champions predictive maintenance at Teck, deploying sensors and analytics to forecast breakdowns. Forget reactive fixes; his systems ping alerts on failing bearings before they snap. In conservative mining, where change crawls, he’s pushed IoT for safety—cameras spotting hazards, automation easing worker risks. Picture drills self-adjusting via data feeds; that’s his vision alive. He’s modernized legacy gear without production dips, slashing costs. Sustainability drives him too: tweaks cut GHG emissions by optimizing fuel use, aligning with Teck’s green pledges. Challenges? Retrofitting old sites resists tech, but Cory Hein’s pragmatic pitches win buy-in. His efforts mirror industry shifts toward smart mines, where data trumps guesswork. Thanks to pros like him, operations run leaner, greener, safer—proving one engineer’s push ripples wide.

Leadership Philosophy and Style

Cory Hein’s style? Straight talk builds trust—no sugarcoating breakdowns, but no blame games either. He empowers teams to own solutions, ditching micromanagement for accountability. Draw from his master’s: foster growth via training, celebrate smarts over hours logged. In Fernie’s tight-knit scene, this resonates—decisions hit neighbors’ livelihoods. He mentors juniors, countering mining’s retiring brain drain with knowledge handoffs. Analogy? He’s the coach drilling fundamentals while eyeing championships. Peers say he sparks collaboration across silos, turning rivals into allies. This human touch boosts retention in grueling shifts. Cory Hein’s approach flips rigid norms, creating resilient crews that innovate under pressure. It’s leadership that sticks because it’s real.

Mentorship and Industry Impact

Beyond his role, Cory Hein pours into mentorship, guiding young engineers through Teck programs. With veterans exiting, he shares war stories on failures-turned-wins, bridging knowledge gaps. He’s shaped culture at Elk Valley ops, where safety stats improved under his influence. Broader? His model aids Canada’s mining push for skilled talent amid labor crunches. Case: juniors he’s coached now lead shifts, crediting his patient breakdowns of complex systems. He ties tech training to leadership, prepping holistic pros. In Fernie, a mining town of 5,000, his community roots amplify impact—local jobs depend on efficient sites. Cory Hein’s quiet advocacy builds the next wave, ensuring industry thrives sustainably. His ripple? Fewer accidents, smarter ops nationwide.

Challenges Overcome

Mining throws curveballs: brutal weather, tight regs, volatile markets. Cory Hein faced 2008’s downturn head-on, stabilizing projects when cuts loomed. Gear failures mid-rush? He rallied teams for zero-downtime swaps. Balancing full-time work with grad school tested grit—late nights analyzing cases after 12-hour shifts. Environmental scrutiny ramped; he adapted processes to slash emissions without output hits. Workforce clashes? His leadership training diffused them, turning friction to fuel. These honed resilience, teaching adaptability trumps perfection. Anecdote: during a harsh winter outage, he improvised fixes saving a month’s coal. Cory Hein’s scars built wisdom, making him the steady hand in storms.

People also like this: Christa Podsedly: Scott Steiner’s Loyal Partner

Future Outlook for Cory Hein

With 17+ years at Teck, Cory Hein eyes bigger horizons—senior exec or consulting? His blend screams C-suite potential, steering strategy amid net-zero pushes. Or he stays put, refining ops where impact’s direct. Tech trends like AI maintenance suit him; expect deeper dives. Fernie’s pull might anchor him, mentoring locals. Whatever path, his blueprint—incessant learning, team-first ethos—inspires. Canada’s mining needs his type as demand surges for green metals. Cory Hein’s next chapter? Likely amplifying sustainability, proving steady innovators win long games.

Conclusion

Cory Hein masterfully wove mechanical prowess with leadership to elevate Teck Resources and Canadian mining. From UBC grad plunging into crisis-era projects to pioneering predictive tech and mentorship, his career spotlights relentless drive. He slashed downtime, boosted safety, greened ops—all while building trusting teams in harsh settings. Why care? Mining powers EVs, renewables; leaders like him ensure it’s responsible. Takeaways: chase dual skills, mentor boldly, innovate practically. You’ll thrive emulating Corey Haim grounded excellence. He’s proof quiet competence reshapes industries—step up, solve real problems, lead with heart.

Frequently Asked Questions (FAQs)

Who is Cory Hein?

Cory Hein is a mechanical engineer at Teck Resources in Fernie, BC, with nearly 20 years driving reliability and leadership in mining.

What education does Cory Hein have?

He holds a BSc in Mechanical Engineering from UBC and an MA in Organizational Leadership from Royal Roads University.

What roles has Cory Hein held at Teck?

Started as project engineer in 2008, moved to reliability engineering, then Shop Maintenance Foreman and senior positions.

What innovations does Cory Hein champion?

Predictive maintenance, IoT for safety, and sustainable practices reducing emissions and downtime at mining sites.

Why is Cory Hein influential in mining?

His tech-leadership blend improves efficiency, safety, and culture, mentoring the next generation amid industry shifts.

Business

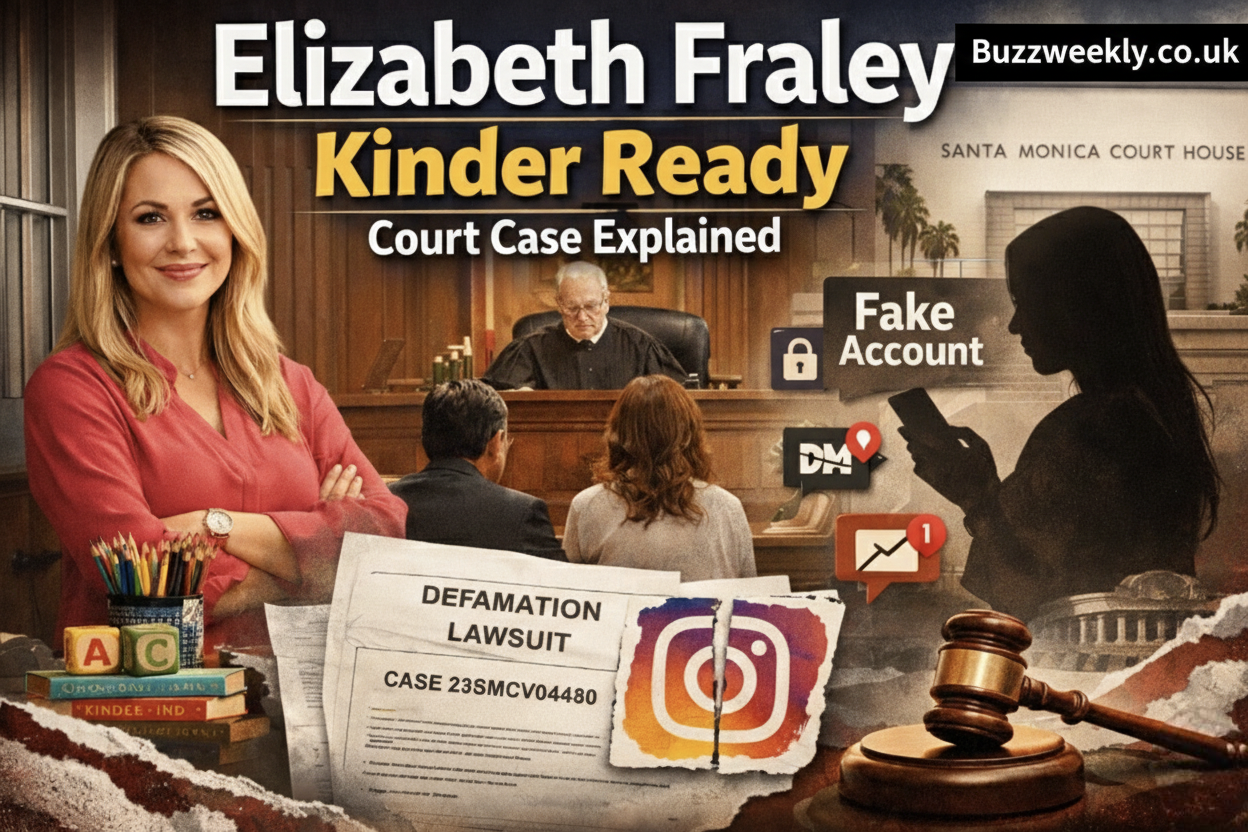

Elizabeth Fraley Kinder Ready Court Case Explained

Imagine discovering harmful rumors about a trusted educator spreading online, threatening everything she’s built for young families. That’s the heart of the Elizabeth Fraley Kinder Ready court case, a brief but intense legal clash in 2023 that grabbed attention in Santa Monica’s tight-knit community. This article dives deep into what happened, why it unfolded so fast, and what it means today for parents eyeing Kinder Ready’s kindergarten prep programs.

Who Is Elizabeth Fraley?

Elizabeth Fraley stands out as a dedicated force in early childhood education. She founded Kinder Ready Inc., a Santa Monica-based tutoring and consulting firm that guides preschoolers toward kindergarten success. With a Master’s in Education from Boise State University, she’s spent over a decade honing programs that blend academics, emotional growth, and social skills.

Will You Check This Article: Rolerek: Smart Sustainable Tech Brand Revolution

Fraley’s approach feels personal, like a neighbor who’s also a pro. She tailors lessons to each child’s needs, focusing on executive function and adaptive learning—skills elite L.A. schools crave. Parents rave about her sessions turning anxiety into excitement for school. Her business thrives at 1112 Montana Avenue, serving Westside families chasing spots in top private and magnet programs.

Yet, her path hit bumps. In 2023, personal disputes spilled into court, casting shadows on her reputation. Fraley didn’t back down; she fought back legally, showing the grit behind her calm teacher vibe.

Here’s a quick snapshot of her background:

| Aspect | Details |

|---|---|

| Education | M.Ed. in Elementary Education, Boise State University |

| Experience | Over 10 years in early childhood education and admissions consulting |

| Company | Kinder Ready Inc., founded 2016, Santa Monica, CA |

| Specialties | Kindergarten readiness, SEL, private school prep |

| Notable Clients | Families targeting Westside independent schools |

This table highlights why families trust her amid the noise of that court case.

What Sparked the Elizabeth Fraley Kinder Ready Court Case?

Tensions boiled over in October 2023 when Fraley, her partner John James Chalpoutis, and Kinder Ready Inc. sued Bobak Morshed and Meline Morshed. Filed in Los Angeles County Superior Court (case 23SMCV04480), it targeted alleged defamation via a fake Instagram account called “Olivia Wilson Haydon.”

The plaintiffs claimed the defendants ran this ghost profile, firing off damaging lies through direct messages to at least ten people. These whispers painted Fraley and her business in a bad light, potentially scaring off clients. Think of it like poison darts in the digital shadows—hard to trace, easy to hurt.

This wasn’t random beef. Earlier friction showed up in a 2022 civil harassment suit by Fraley and Chalpoutis against Bobak Morshed at L.A.’s Stanley Mosk Courthouse. Details stay fuzzy, but it hints at deeper grudges, maybe from neighborhood spats or business overlaps. By 2023, social media became the battlefield.

California courts slotted it as “Personal Injury – Other Personal Injury,” defamation’s home turf. No kids, no classrooms—just adults hashing out reputational wounds. Fraley saw it as a must-defend stand for her life’s work.

Key Timeline of the Court Case

Events moved lightning-fast, unlike most lawsuits that drag on. On October 9, 2023, the complaint dropped in Santa Monica Courthouse under Judge H. Jay Ford III. Defendants got hit with papers via substituted service on November 2—leaving docs with adults at their spots when direct handoffs flopped.

Just 25 days later, on November 27, plaintiffs pulled the plug with a “dismissal without prejudice.” A case management conference set for April 2024? Canceled. Total active time: mere weeks, not the months of discovery or trials you’d expect.

That speed raises eyebrows. Picture a sprinter bolting from a marathon—over before the crowd settles in. No hearings, no evidence swaps, no judge’s gavel on truth or lies. The file closed quietly, leaving questions hanging.

Inside the Defamation Allegations

Defamation in California demands proof: false words, shared widely, reputation harm, and sloppy or worse intent from the speaker. Fraley’s team argued the Instagram phantom hit all marks, zapping trust in Kinder Ready.

Specific dirt? Court papers skipped quotes, but harm felt real—families might dodge her door over whispers. For a boutique educator relying on word-of-mouth, that’s brutal. It’s like a chef’s bad Yelp review snowballing, but sneakier via DMs.

Proving puppet-mastery over a fake account? Tricky. Needs subpoenas to Instagram for IPs, logins, devices. VPNs and burners muddy it fast. Small players like Kinder Ready face steep costs here, often killing cases early.

This mirrors rising online smears. Businesses fight phantoms daily, balancing legal bills against quiet fixes. Fraley’s bold filing showed spine, even if it wrapped quick.

Why Did the Case End So Abruptly?

Dismissal without prejudice means Fraley could refile later, within defamation’s one-year window. No forever ban, unlike “with prejudice” slams. Courts stayed mute—no wins, losses, or finger-points.

Speculation swirls: settlement? Smart money says yes. Many dust-ups settle privately; cash or promises swap hands off-record. Litigation bites hard—lawyers, filings, experts drain pockets fast for solos like Fraley.

Anti-SLAPP laws loomed too. California’s shield against speech-chilling suits lets defendants bail early if claims touch public interest. No motion filed here, but it shapes strategies. Or maybe evidence thinned; digital trails vanish quick.

Bottom line: practicality won. No public scars on anyone. Fraley likely weighed risks, chose peace over prolonged war.

Broader Disputes Involving Fraley

Zoom out: 2022’s harassment case adds layers. Fraley and Chalpoutis targeted Bobak Morshed again, under Judge Laura Cohen. Outcome? Disposed, details scarce. Ties to 2023? Unclear, but patterns scream ongoing feud.

Layer on 2023 news: a Brentwood landlord eviction flap. Owner claimed Fraley owed pandemic-era rent, ran business from a residential lease. She countered with repairs woes, mold, a two-year restraining order against him. Court filings flew, but no deep rulings surfaced.

These threads paint Fraley as fighter in personal storms. Not the classroom saint alone, but human navigating L.A.’s messy orbits. No child-safety flags or biz shutdowns—just adult tangles.

Impact on Kinder Ready Business

Kinder Ready chugs on strong. No closures, no probes from California’s child ed watchdogs like Social Services. Parents still book for readiness assessments, SEL boosts, private school drills.

Reputation dips hurt most. Searches for “Elizabeth Fraley Kinder Ready court case” spike worries. Yet, no judge tainted her services. It’s rumor-vs-reality: filings allege attacks on her, not flaws in her work.

Compare fallout:

| Factor | Typical Long Case | This Quick Dismissal |

|---|---|---|

| Duration | 1-3 years | Weeks |

| Court Rulings | Verdicts, findings | None |

| Business Ops | Often disrupted | Unaffected |

| Public Record | Extensive dockets | Minimal filings |

| Refile Option | Limited/none | Open (without prejudice) |

This chart shows why Kinder Ready dodged major hits.

Fraley keeps innovating—anti-bias initiatives, humor in learning. Her site’s buzzing with testimonials, like CNN’s Lisa Ling praising fun gains. Case or not, mission endures.

People also like this: FSI Blogs US: Essential Guide to Financial Insights

Lessons from Social Media Defamation Fights

This saga spotlights digital-age pitfalls. Fake accounts sling mud cheaply; victims chase ghosts. Platforms drag on subpoenas; costs soar.

Tips for biz owners: screenshot everything, monitor mentions, report TOS breaches first. Weigh lawyers vs. PR fixes. Fraley’s quick pivot? Textbook smart.

Like a storm cloud passing, it tests resilience. She emerged focused on kids, not grudges.

Conclusion

The Elizabeth Fraley Kinder Ready court case boiled down to a fast-filed, faster-dropped defamation suit over Instagram whispers, dismissed without rulings or fallout. It revealed personal feuds but cleared no hurdles for her thriving education biz. Key takeaway: verify facts beyond headlines—courts spoke little, but her work speaks volumes. Parents, chat directly with Fraley; dig service reviews, not rumor mills. You’ve got this—choose confidently for your little one’s bright start.

Frequently Asked Questions (FAQs)

What was the outcome of the Elizabeth Fraley Kinder Ready court case?

The 2023 defamation suit (23SMCV04480) got dismissed without prejudice in November, just weeks after filing. No trial, no rulings—just voluntary withdrawal, keeping refile options open.

Did the court find Kinder Ready or Elizabeth Fraley guilty of anything?

Nope. The case alleged attacks on them, not wrongdoing by Fraley or her company. Dismissal meant zero judicial findings against anyone.

Is Kinder Ready still operating after the court case?

Yes, fully. Located in Santa Monica, it offers tutoring and prep programs with no interruptions or regulatory issues tied to the case.

Why was the Elizabeth Fraley Kinder Ready court case dismissed so quickly?

Likely settlement, high costs, or evidence hurdles common in social media cases. It wrapped in 18 business days post-service, avoiding drawn-out fights.

Should parents worry about the court case when choosing Kinder Ready?

Not really—it’s unrelated to teaching quality or child safety. Focus on reviews and direct consults; the business runs strong today.

-

Leadership and Innovation3 hours ago

Leadership and Innovation3 hours agoIs Elizabeth Rizzini Still Married? Inside Her Private Life in 2025

-

Business1 week ago

Business1 week agoMark McCann Net Worth 2025: Supercars And Millions

-

Blogs1 week ago

Blogs1 week agoRox.com Products Catalog: Ultimate 2025 Guide

-

Blogs1 week ago

Blogs1 week agoRodwajlery: Loyal Guardians with Ancient Strength

-

Tech1 week ago

Tech1 week agoCamehoresbay: Exploring a Modern Digital Hub

-

Sports2 days ago

Sports2 days agoAC Milan vs SSC Bari Timeline: A Historic Italian Rivalry

-

Celebrity1 week ago

Celebrity1 week agoDorothée Lepère: Interior Designer and Entrepreneur

-

Tech1 week ago

Tech1 week agoPxless: A New Way to Think Beyond Pixels